DKZ Technologies in Madhapur ‘cheated’ over 30,000 investors in Rs 700 crore fraud

The company hired popular YouTubers and influencers to promote its business due to which many victims invested in the company

By Sistla Dakshina Murthy

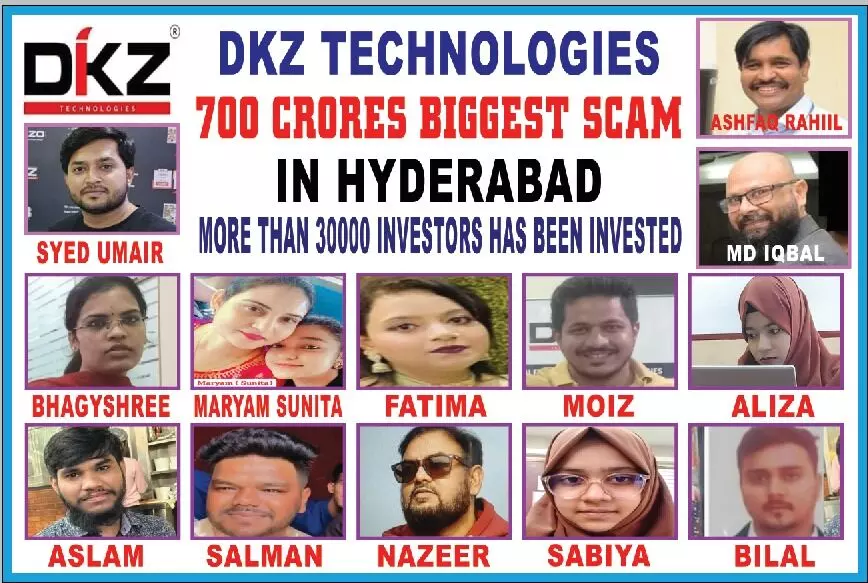

DKZ Technologies Staff

Hyderabad: A Rs 700 crore fraud allegedly involving funds taken from over 18,000 investors has come to light.

Taking to his X account, Majlis Bachao Tahreek (MBT) spokesperson and former GHMC corporator Amjed Ullah Khan said that a bogus firm called DKZ Technologies duped over 18,000 investors of Rs 700 crores.

According to a press conference held by the victims, the number of people duped by DKZ Technologies in Hyderabad can be around 30,000.

NRIs from Telangana, Maharashtra and Karnataka targeted

Currently, the company has closed its office in Madhapur leaving the investors worried.

“From a mere 1,000 investors in 2022, their firm received 18,000 investors to the tune of Rs 700 crores from three States – Telangana, Maharashtra and Karnataka – especially from the NRIs living in Saudi Arabia, Kuwait, UAE, Qatar, Muscat, USA, Australia, United Kingdom and Canada. In August, the fraudsters who formed the firm DKZ Technologies stopped paying the monthly instalment (profit) to the investors, closed all their establishments and ran away,” the MBT spokesperson said.

“What was the State Intelligence Department doing since 2018 even after two persons registered a bogus firm and looted the common man to the tune of Rs 700 crores? As this scam covers three States and many NRIs it’s better that the Telangana State government should hand over this case to the Central Bureau of Investigation (CBI) and the role of former home minister Mohammed Mahmood Ali and YouTubers also be investigated and properties of the bogus firm should be attached,” Khan said.

‘DKZ Technologies promised 8 to 12 per cent interest’

Speaking to NewsMeter, Afroz Khan, a private employee, explained how DKZ Technologies promised him to pay 8 to 12 per cent interest per month on his investment of Rs 5 lakhs. However, the output never materialised.

“Anticipating high returns, I invested Rs 5 lakhs from my savings in the firm in May and chose a six-month plan. Accordingly, the firm promised to pay a monthly interest starting in June. However, the company representatives stated that as per the RBI guidelines the firm is upgrading its payment software which takes some time to pay monthly interest to him,” Afroz Khan said.

Trusting the company representative’s words, Afroz did not approach the company for a few more days.

“In August, I went to inquire with the company representatives about the monthly interest payment for my investment. However, a notice was placed in front of their office in Madhapur stating that the company had closed its office. With no option left, I approached my friend’s brother and came to know that DKZ Technologies duped scores of investors like him, they approached the police seeking justice,” he said.

More victims speak out

Another victim Mujeeb Basha, an IT employee told NewsMeter that he had invested Rs 7 lakhs in two phases in August from his savings.

“I chose a one-year plan offered by DKZ Technologies. As per the agreement entered with the company, it should start paying monthly interest of Rs 60,000 (Rs 5 lakhs) and Rs 22,000 (Rs 2 lakhs) for 45 days. However, the firm shut its operations at the end of August. I am very much concerned about my investment now. I am running from pillar to post to find the owners of the firm and get back my investment. I approached the Madhapur police and came to know that scores of people from all walks of society have been duped by the company,” Basha said.

He also appealed to the police to arrest the culprits and ensure their investment back by selling the assets of the company.

Background of DKZ Technologies

Advocate Aaashir Khan said that a joint complaint was filed by Abul Jaish and 10 others with the Cyberabad Police against DKZ Technologies/Dikazo Solutions Private Limited and its directors, namely Ashfaq Rahil and Iqbal, along with several managers and employees for cheating and defrauding investors, including himself, who have collectively invested substantial sums of money in the company-approximately around Rs 25 crores, though the actual sum may exceed Rs 100 crores.

Advocate Aaashir said the company was established in 2018 by Ashfaq Rahil and Iqbal under the names Dikazo and DKZ Investments, purportedly to help those in need.

The directors informed investors that they were engaged in B2B and B2C businesses. They opened stores such as Dikazo in Madhapur and Hourly Fresh in Chaderghat, claiming to have partnerships with Amazon for the delivery of 4,000 orders per day and with BOULT, a company specialising in headphones and neckbands.

Sources said that the directors lured investors by giving monthly profits ranging from 8 to 12 per cent on their investments.

Using YouTubers for luring investors

Afroz said that he had come across DKZ Technologies through YouTube as several influencers have promoted the firm extensively in 2023.

“Apart from that, one of my friend’s brother also invested his savings into the firm and received the monthly interest from the firm which forced me to invest in the DKZ technologies,” he said.

The company also hired popular YouTubers and influencers to promote its business due to which many victims invested in the company.

The company used photos of former minister

To gain investors’ confidence, the fraudsters even posted videos and photos with former deputy chief minister and minister for Home Mohammed Mahmood Ali.

Till the end of 2022, there were very less investors but the fraudsters involved many YouTubers – Abdul Razzaq (Golden Hyderabadies), Kafeel aka Taffu, aka Comedy Ka Hangama, Priya Reddy aka Kirak Khala, Imran aka Immi, Najeeb of Warangal Dairies and Mohammed Bin Ishaq of Baigan Vines, Amjed Ullah Khan.

Khan also said that all the YouTubers were paid Rs 1 lakh for each video and promoted their business and all the above YouTubers made small videos claiming these investments as Halal Investments and they even showed that they had also invested in the above firm.

The company owners also took the services of Syed Umair and appointed him as a manager who used to make videos daily on his personal account on Facebook, YouTube and Instagram and lure the investors and services of Aslam, Fatima, Syed Nazeer, Moiz, Salman, Bilal, Sohail, Sunitha aka Maryam, Bhagyalaxmi, Alina Ruhi.

The company released initial amounts

The company consistently paid out profits to investors on time until June 2024.

However, the July payout was delayed. When investors contacted the company, they were met with false claims that the delay was due to ongoing processes to obtain NBFC certification as per RBI regulations.

The advocate further said that the company assured investors that profits would be released within a week.

To maintain a facade of legitimacy, the company released small amounts under Rs 50,000 to some investors, claiming they were working to resolve the issues. The payment date was postponed several times by the managers and owners, with the final date set for August 30. On August 29, the office was closed at night in the presence of some investors who were there to inquire about the payment status.

Investors woke up to a closed office

On August 30, a notice was attached to the office wall stating that the office was closed due to an alleged incident in which a female employee was physically assaulted by an investor. The notice claimed that the nearest police station had been informed and that the office would reopen after receiving police security on the following Monday or Tuesday.

Following the office closure, investors panicked and attempted to contact the owners, managers, and staff, but their calls were unanswered, and the employees’ phones were switched off. Suspecting that the company was absconding, a group of over 200 investors gathered at the office on Saturday and decided to file a case at the Madhapur police station.

The inspector directed the case to the Economic Offences Wing (EOW) as the alleged fraud exceeded Rs 75 lakhs.

The complainants' request that a criminal case for cheating is lodged against the following owners, managers and employees under Section 3 of the Depositors Act, along with Sections 420 and 138 of the IPC. Many investors have invested in the company by taking loans, pledging gold ornaments, and submitting house documents.

As per the endorsement of the DCP, CCS, DD, Hyderabad, and as per the contents of the above complaint a case was registered (200/2024), under sections 403, 406, 420 r/w 120-B IPC and the case file handed over to E Jahangeer Yadav, inspector, EOW Team V, CCS, DD, Hyderabad for further investigation, advocate Aaashir said.